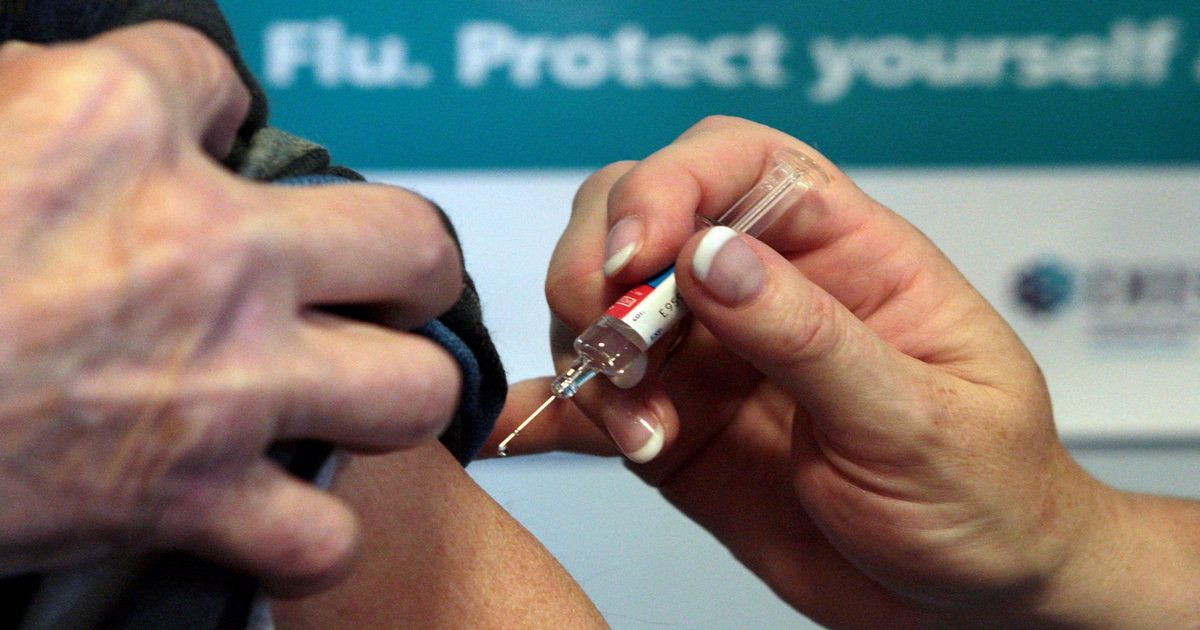

Despite warning us off the rise of ERIS, son of Omicron, the media also reports the Government is to no longer provide Covid OR Flu shots for anyone under the age of 65! What’s going on?

Find a whole lot more at https://davidvance.net

Visits: 164

I will not submit, I will not comply